louisiana estate tax return

If none of this is important then you. They can also submit their returns using commercially available tax preparation software or with printed state returns available at.

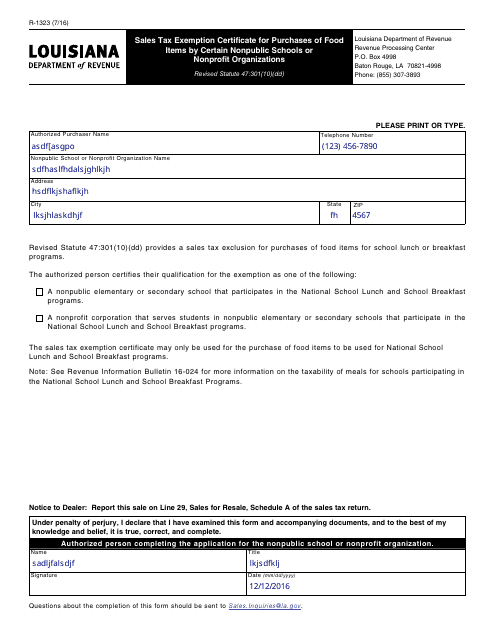

Form R 1323 Download Fillable Pdf Or Fill Online Sales Tax Exemption Certificate For Purchases Of Food Items By Certain Nonpublic Schools Or Nonprofit Organizations Louisiana Templateroller

The gift tax return is due on April 15th following the year in which the gift is made.

. Estate transfer tax return. The taxes imposed by this Chapter upon individuals shall apply to the income of estates or of any kind of property held in trust including. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

Franchise Tax Partnership Tax Fiduciary Income Tax. Parish E-File permits the filing of multiple parishcity returns from one centralized site. By submitting an extension request you are requesting only an extension of time to file your Louisiana Fiduciary Income Tax return.

IT-540 Individual Income Tax Resident Return IT-540B Individual Income Tax Nonresident Part-Year Resident Return IT-540ES Individual Income Tax Estimated Tax Voucher R-540INS Individual Refund Request of LA Citizens Property Insurance R-1029 Sales Tax Return CIFT-620 Corporation Income Tax Franchise Tax. An estate tax return shall be mailed to both the collector of revenue and the person designated as the tax collector under the provisions of RS. Parish E-File is an online tool that facilitates secure electronic filing of state and parishcity sales and use tax returns.

Louisiana Department of Revenue Taxpayer Services Division P. 472417 within nine 9 months after. Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one.

Individual Income Tax Corporate Income. You are required to have an LDR account number. Payments received after the return due date will be charged interest and late payment penalty.

1 have no impact on 2021 state income tax returns and payments due May 16. This service is available 24 hours a day. 4 on the next 40000 of Louisiana taxable income.

Taxpayers can file their returns electronically through Louisiana File Online the states free web portal for individual tax filers. Returns and payments are due on May 15th of each year on the preceding years income or on the 15th day. Fiduciary Income Tax Return For estates and trusts PO.

Completing Form IT-541 Fiduciary Income Tax Return Who Must File a Return Louisiana Revised Statute RS 47162 provides that every resident estate or trust and every nonresident estate or trust deriving income from Louisiana sources is liable. Louisiana State Tax Return - I had my taxes done and was E-filed 4 weeks ago. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

Imposition of tax on estates and trusts. And 4 name an executor to collect the assets of your estate pay any bills due and distribute your estate to your heirs. Yes Louisiana imposes an estate transfer tax RS.

Welcome to Online Extension Filing. Fiduciary Income Tax Who Must File. The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the Federal Internal Revenue Code.

This application will walk you through the process of filing an extension for your taxes. LA Rev Stat 47181 2017 SUBPART C. 3 make provisions to save estate taxes for larger estates.

Initial return Amended return Final return Name of estate or trust C Federal Identification Number D Date entity created Name and title of fiduciary E Type of entity Decedents estate Simple trust Complex trust. 31 rows Generally the estate tax return is due nine months after the date of death. 473001 provides the tax to be assessed levied collected and paid upon the Louisiana taxable income of an estate or trust shall be computed at the following rates.

Box 3440 Baton Rouge LA 70821-3440 A Mark applicable boxes. Select the tax type for which you want to request a filing extension. 2 on the first 10000 of Louisiana taxable income.

The amount of the state estate tax is equal to the federal estate tax credit allowed for state death taxes. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount.

Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the deceaseds net estate is 6000000 or more. 1 Income accumulated in trust for the benefit of unborn or unascertained person or. LA Rev Stat 472436 2021.

Individual Income Tax Resident Non-Resident Athlete Declaration of Estimated Income Taxes. Every resident estate or trust and every nonresident estate or trust deriving income from Louisiana must. This request does not grant an extension of time to pay the tax due.

Welcome to Parish E-File. The estate would then be given a federal tax credit for the amount of state estate taxes that were paid. 2021 Louisiana Laws Revised Statutes Title 47 - Revenue and Taxation 2436.

Original return Amended return Partial return Date of originalaaa Real estate Louisiana property only Stocks and bonds Mortgages notes and cash Insurance Other miscellaneous property. For other forms in the Form 706 series and for Forms 8892 and 8855 see the. 2 create a trust for grandchildren special needs heirs or spendthrift heirs.

Taxpayers should be collecting and remitting both state and parishcity taxes on taxable sales. BATON ROUGE The filing and payment deadline for 2021 state individual income tax is Monday May 16. Tutor in Louisiana for minor children.

The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and.

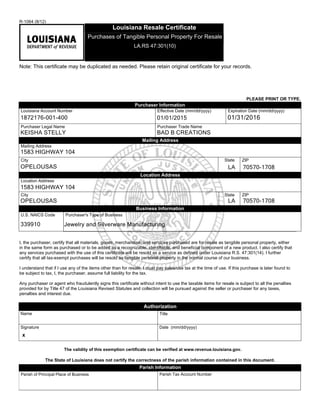

Filing Louisiana State Tax Things To Know Credit Karma

Louisiana Succession Taxes Scott Vicknair Law

Louisiana La Tax Rate H R Block

Louisiana State 2022 Taxes Forbes Advisor

Louisiana Inheritance Laws What You Should Know Smartasset

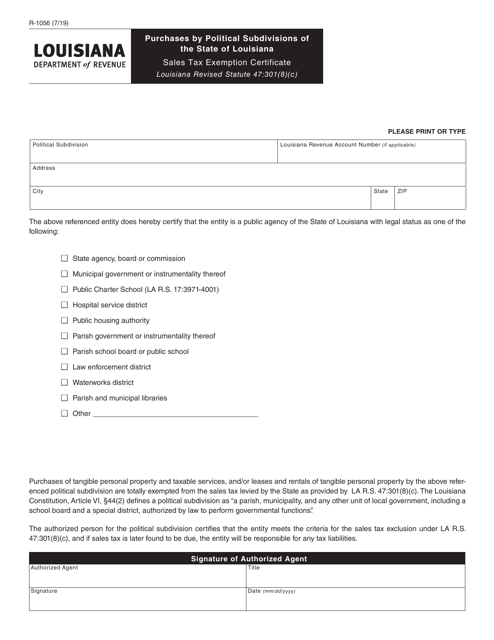

Form R 1056 Download Fillable Pdf Or Fill Online Certificate Of Sales Use Tax Exemption Exclusion Of Purchases By Political Subdivisions Of The State Of Louisiana Louisiana Templateroller

Tax Exemption Form Fill Online Printable Fillable Blank Pdffiller

Louisiana Income Tax Reporting And Audit Regime Updated

Where S My Refund Louisiana H R Block

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Louisiana Grants Extensions For Businesses For Hurricane Ida

Louisiana Inheritance Tax Estate Tax And Gift Tax

Louisiana Tax Deadline Extension And Relief For Winter Storm Victims The Turbotax Blog Tax Deadline Winter Storm Victims

Louisiana Inheritance Tax Estate Tax And Gift Tax

Thousands Of Louisiana Taxpayers Who Got Extra Refund Should Sit Tight State Says State Politics Theadvocate Com

Estate Taxes New Orleans Orleans Parish Louisiana Lawyer Attorney Law Firm